The High Ground

Introduction

This memo is an attempt to answer the question of where the "high ground" will be in software and computing outside of foundation model providers in the period 2026-2031. The backdrop being the proliferation of AI, both in terms of its persistent distribution into wider contexts of consumer and enterprise software, as well as its greater use in writing software.

AI in Consumer and Enterprise Software

It is no great risk to predict that AI is going to continue to permeate software. This catalyzes four main changes compared to the status quo.

- General systems growing at the expense of highly specialized ones. This is a function of the general understanding characteristic of all major LLMs.

- The ability of software systems to be controlled by and made customizable through natural language.

- The ability for software to become self-aware. Plugging code and user behavior into LLMs allows for an almost emergent capability, resulting in self-aware software.

- The primacy of context in highly generalizable systems. Specialization is derived not from the predetermined architecture in the software, but rather from the general availability and thoughtful application of the most relevant user/business context at run/inference time.

AI in Software Creation

It is also clear that AI is starting to dramatically change how software is written. We can similarly characterize four dimensions of this change:

- The cost of software creation will go down. There will be more software.

- Who writes software will change. Barriers to entry are falling as models with general capabilities are being harnessed by those without general capabilities but with specialized knowledge and taste.

- Because these capabilities become generally available, software written by LLMs will become the median software, in other words, mediocre. The great firms that will win in their niche will have to be steered either by software architects with unique insights into how to engineer their systems efficiently and scalably, or by artisans and craftsmen who wed unique market insights and taste with the general capabilities of the LLMs.

- AI is increasing the participation rate, both in terms of who's writing the software, but also in terms of how end users can adapt software to their unique preferences. The best systems therefore will be open, adaptable, allow for contributions from a broader developer community, and also provide high degrees of customization by their own end users.

A note on Social Media

Even before the machines have landed in a big way on social media, it is apparent that in general, satisfaction with social media is low.

The platforms are fragmented even while they are owned by an ever more concentrated set of hands. The algorithms drive their users towards content that generates an itch-scratch cycle of stimulation and craving.

When you listen in on conversations at restaurants and bars, it is no exaggeration to say that often social media use is considered with disgust and self-loathing. It is not something we want to expose to our children, and it is not something that is enriching our lives or our relationships.

Of course, there are a few pockets of communities for whom social media is still a net good. People who are bound together by a craft or by shared passions or interests. But these pockets of real utility are generally oases in the desert. Meaningful digital interactions between humans exist primarily within private spaces like messengers, chats, some forums, and email correspondence.

The High Ground

The high ground will be at the intersection of humans interacting with each other and with preeminently capable, customizable, and personal systems which are delightful, simple to use, and retain the user's trust.

Let's break each one of those aspects down.

Interaction: As quantum physicists know, the universe emerges more from how objects interact rather than from what objects are. As machines gain the ability to understand natural human language, we will want to stream information that is informed through interactions rather than create and maintain static information structures.

Capable: This means state of the art agentic capabilities paired with precision and the absence of major mistakes.

Customizable: This means that the end user (be they an individual, small business or company), can modify the system to the greatest possible degree according to their own preferences, and do so easily and intuitively.

Personal: This goes beyond customizability even as it emerges partially from it. It means that a system incrementally feels like it belongs to the end user. It has adapted to the unique context of their lives and character.

Delight: The system itself surprises the end user and brings them joy. There is a sense of wonder and light when one interacts with it.

Simple: It is uncomplicated to begin with the software and to interact with it.

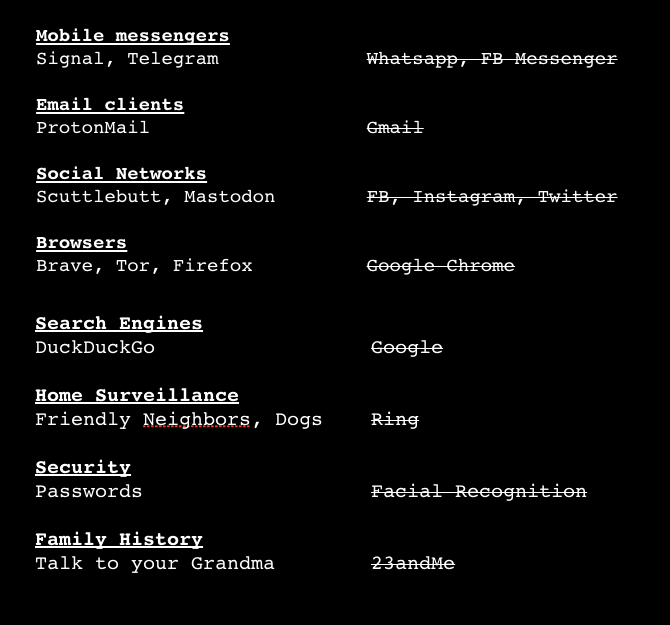

Earning and Retaining Trust: How the product and the Company behind the product present themselves with credibility, engage with user context with transparency and refrain from abusing user trust or exposing the user to unacceptable security risks.

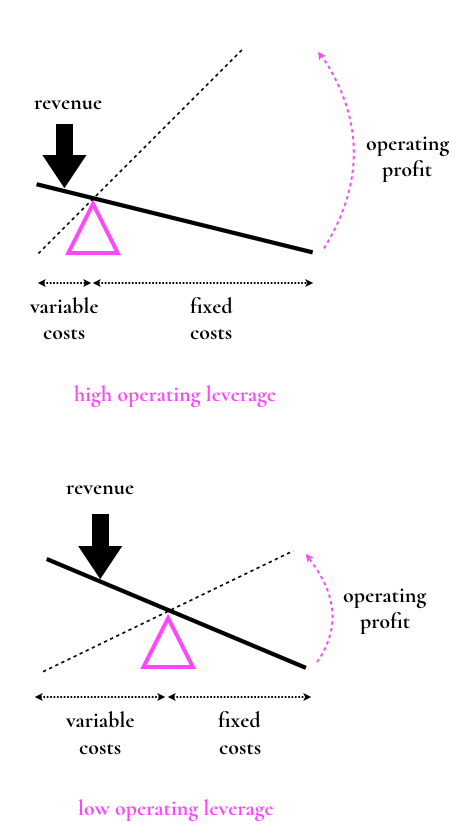

Achieving that high ground through executing on the aspects above means unlocking an essential positive feedback loop between usage and context. Greater usage leads to deeper context, deeper context leads to more precise behavior by the system, more precise behavior by the system (particularly relative to peers or competitors) leads to greater usage. We believe that to the extent it retains the qualities above, the system should be maximally user-owned.

Final Thoughts

We end with a new framing.

Imagine a garden. Place yourself there in your mind's eye. You choose what to grow there. You tend to it with care. Your garden may be fenced to make it distinct from the gardens and spaces of others. It is a safe space, but it is not completely isolated from the world. Weather and climate and the outside world will confront you with constraints. Over time, your garden comes to reflect how you react to those constraints and decisions you have made over the years. Over time, your garden reflects you.

In your garden lives an entity. The entity is rooted within your garden but is intelligent, worldly, and capable. This entity primarily exists to guide and help you, but can also interact with others. It knows deeply every inch of your garden, every budding flower, every fruit, even as it relates what is in your garden to the wide world outside. Like your garden, this entity comes to reflect you. You can send your entity forth from your garden, but even then it is colored and rooted in the choices you made in that dirt.

At Earendil we are building the Entity and the Garden. Our system emerges from them both. We call it Lefos.

Authored by Colin Daymond Hanna without the assistance of an LLM